HOMER Grid 1.9

![]()

The Solar Energy Industries Association (SEIA), has designed an investment tax credit, to encourage the deployment of solar energy in the United States. The ITC is a 30% tax credit for commercial and residential buildings. This allows the business or individual home owner to apply the credit to their income tax. Though the ITC is applied to the solar panels purchased, it can also be applied to solar and storage assets. However the requirement for a solar and storage system to be eligible for the ITC is not as straightforward. Since the storage is not considered a renewable source of power, to be eligible for the tax credit, the battery has to be charged from Solar at least 75% of the time. The portion of ITC the storage will receive will be proportional to the percentage of time it is charged by solar. So to get 100% of the ITC credit, it need to be charged by solar only.

In HOMER Grid, you can apply an investment tax credit to the following components:

•Solar

•Storage

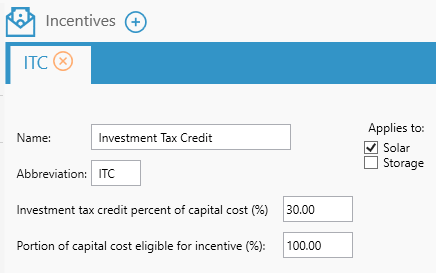

Below is an explanation of the various inputs in Investment Tax Credit

Variable |

Description |

Percent credit (%) |

Investment tax credit percent of capital cost (%) |

Eligible percent (%) |

Percentage of the capital cost eligible for the incentive |

Applies to |

The components that this bonus depreciation applies to |

Example

Let us consider a PV system of 100 kW which has a total capital cost of 100,000$. If the bonus depreciation applied to this PV system is as shown below:

This ITC = 0.30 * 100,000$ = 30,000 $