HOMER Grid 1.9

Depreciation is a way of reducing the value of a purchased asset over its usage. It indicates how the value of the asset will decrease over time.

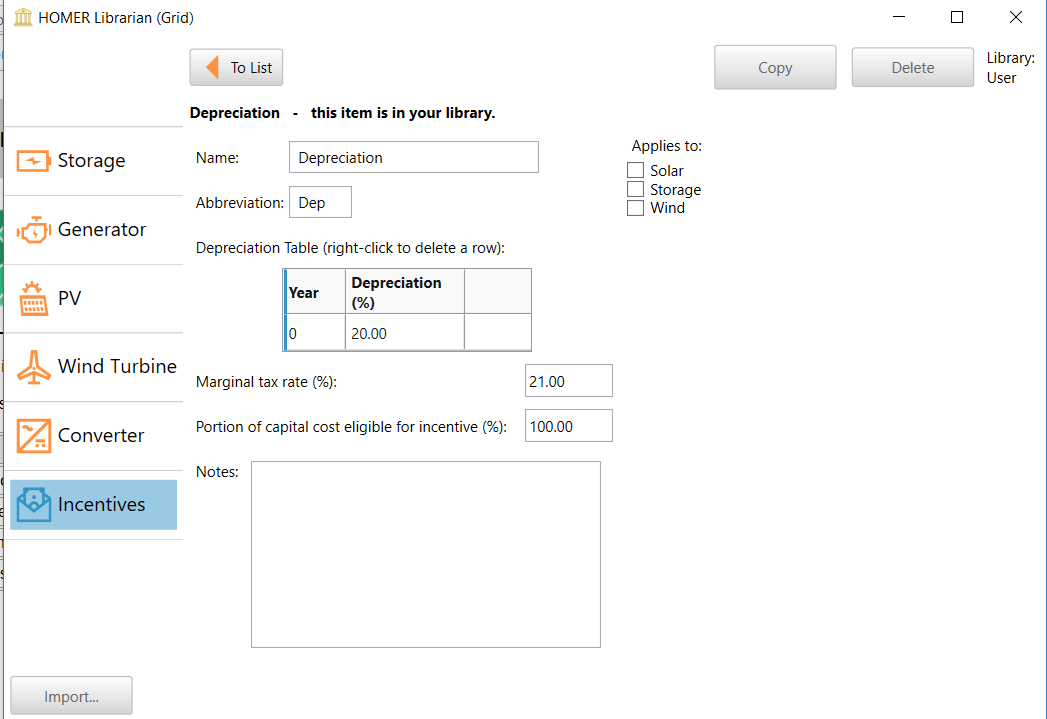

Below is an explanation of the various inputs in Depreciation

Variable |

Description |

Depreciation curve (%) |

The year by year depreciation percentage |

Eligible percent (%) |

Portion of capital cost eligible for this incentive |

Marginal tax percent (%) |

Marginal tax rate |

Applies to |

The components that this bonus depreciation applies to |

See also